Dear Partners,

The return of the fund ended the year at 17.72 % vs 28.79% of the S&P 500 index. This was the 21st largest rise in the SP500 index since 1926. In the past 4 and half years, SP 500 returned an average of 18.56% vs 10.2% between 1965 and 2020. Obviously, it has become difficult to beat the market recently. Even if we made a return this year, sub 20% performance is definitely not to my liking. We had strong returns by October, as the time passed, certain investments I made in the 4th quarter generated unrealized negative returns for the year dragging overall portfolio gains lower. However, it is my belief those investments will yield above-market returns in the upcoming 2 -3 years as I hold the view that my entry point would be qualified as below fair price.

| Year | Portfolio | S&P 500 |

| 2017 Jul-Dec | 13.8% | 9.2% |

| 2018 | -9.96% | -6.2% |

| 2019 | 36.3% | 28.9% |

| 2020 | 32.6% | 16.3% |

| 2021 | 17.72% | 28.79% |

| Cumulative Return | 118% | 98% |

| Compounded average Return | 21.51% | 18.56% |

Investments

Our avenues of investment break down into two categories.

The first, are the companies that we believe are undervalued and generate strong revenue growth year over year, and volatility of the stock price is usually high. The aim of these investments is to achieve above-market returns in the long run. You might think the first category entails what are so-called “growth” stocks. I don’t necessarily divide companies into “value” vs “growth”. I believe, that viewpoint is misleading and unnecessary. As long as a company’s management can deliver excellent growth for its shareholders without requiring too much capital to be invested down the road externally and can sustain its growth internally and the stock is sold at a reasonable price, I would rather call it “value” rather than “growth”.

The second part is the companies that play as insurance and a hedge against the companies mentioned in the first part. The purpose of these firms in the portfolio is to reduce the volatility, the downside for the portfolio and achieve at least market-rate returns. I believe the combination of these two strategies is aimed better at reducing the downside loss and taking advantage of the upside. At the moment of writing, second-type securities are about 45% of total assets.

Two companies that we have large positions in are Alibaba and Berkshire Hathaway and each of them falls into the categories mentioned above respectively. I will not delve into a deeper analysis of each since it is not a scope of the annual letter however, I might consider writing up a longer analysis separately. However, I will give a small explanation about both.

We used to own Alibaba in 2017 and I sold the position 2 years later at 172$ per share for a small gain as I found better opportunities elsewhere. The stock price peaked at 310$ in Oct 2020, and it’s been downhill since then, at the time of writing it trades at 119$, way lower than what I paid for 4 years ago. In hindsight, I looked stupid when the price rallied from 172$ to 310$, but now in hindsight, I look smart for selling at 172$. What an odd feeling not to know which one is better or worse. However, a lot has changed since then in the company’s operations, the business model in the positive direction. Alibaba is a mix of retail, e-commerce, iCloud business operation functioning domestically in China and internationally. The company’s revenue growth is still above 20% due to acquisitions and organic growth. But events that occurred in the past year around regulations and political tension between US and China have taken major Chinese companies down not just Alibaba. Alibaba however, is the one that has been oversold in my view. However, partners have to bear in mind, Alibaba’s investment might bear fruit for any investor holding 2-3 years minimum. The security is about 20% of assets and if the environment becomes more favorable I might increase the position going forward. Alibaba offers asymmetric risk-reward which I am always after. My current expectation is the security can yield around 20% average annual return for the next 3 years. I don’t have a crystal ball but I have outlined how it might happen below. On the other hand, if I see events to turn against my hypothesis, I will be ready to exit.

The second company that we have a large position and is included in the second category mentioned earlier is Berkshire Hathaway. It is the only company that has been part of my portfolio since the fund more than 4 years ago. Berkshire serves 2 purposes. The company is less volatile than the overall US market especially to the downside and it is undervalued. Rather than owning the overall US market index, I believe Berkshire is a far better option to reduce the risk. You receive less volatility, less downside, and if the economy performs well, the security might beat the market, especially in the long run. When Berkshire is mixed with first category companies, you can achieve the volatility of SP500 but expected high returns (Higher Sharpe Ratio).

A little bit on how I approach investing

I try to combine various investment thoughts, wisdom from successful investors – Warren Buffett, Charlie Munger, Peter Lynch, Joel Greenblatt, Ray Dalio, etc, and one of those is George Soros who advocated the theory of reflexivity which I want to talk about here and how it influences my decision-making process to a certain extent.

I would highly recommend you to read his book “The Alchemy of Finance” if interested, the short version of the theory he mentioned in the book can be found here (https://en.wikipedia.org/wiki/Reflexivity_(social_theory)). But unless you read the book (and not once, a few times) you will not understand it very well. I learn something new every time I read it. The book has been on my desk for a long time.

One part of the theory is that there is a reflexive reaction between the prices of stocks and fundamentals. What most perceive is fundamentals impact the stock price, but Soros says prices in its turn affect the expectations of market participants. Those expectations will later impact prices further. The theory is more likely applicable to macro events, but it can be applied to individual securities as well. Let’s look at it in the example of Alibaba and how the theory can give us an advantage in understanding events. Since Jack Ma decided to “charge” on CCP’s policies last year-end (October 24th, 2020. https://interconnected.blog/jack-ma-bund-finance-summit-speech/ Funny fact, BABA was at an all-time high a day before), the Chinese government halted the IPO of Ant Financial which Jack Ma has a stake in. Later, further tech crackdown followed suit. Jack Ma’s short-term “disappearance” caused havoc on the Chinese market. In 2 months, 800bln$ market company lost about 30% of its value. From the perspective of the theory, 3 parts play a role – underlying trend, prevailing bias, and stock price. These forces can result in self-correcting or self-reinforcing trends. They can pull each other, affect one another. Jack Ma’s silence after the summit, halting of IPO changed market participants’ views and the stock price started to decline. But that does not mean the underlying trend was broken in the earlier weeks, which were upwards. It had to be tested.

By Nov 13th, the price dropped by 16% to $260, in the next week, the price tried to recover and continue its upward trend. However, it could not hold, a week later after rising by about 6%, by Dec 24th, the stock lost another 20%. The underlying trend had been broken and the prevailing bias of market participants had changed into negative territory. The trend had become self-reinforcing downward. The trend couldn’t hold since no positive news was emerging and considering all the news on the media was negative – China’s tech crackdown, delisting risk of Chinese companies from American exchanges by SEC if certain audit regulations not met, and also by Chinese regulators. I believe this self-reinforcing trend continued till the end of this year, and I start to see it is exhausted. When the self-reinforcing trend continues for a period, eventually it is replaced by a self-correcting trend(unless the business is shady like Enron then the trend goes one way). Therefore, you see boom and bust cycles. Also, it is important to point out that I believe Chinese regulators did not expect this much sell-off and market reaction when they initiated the crackdown against companies. Therefore, they will go easy going forward not to spook the market and for the past few months, it seems to be the case. As the 20th Party Congress approaches in 2022, the focus has shifted already.

In this round, the self-correcting trend will need to test the negative underlying trend that exists today. To break it, few more positive news need to be made to change negative prevailing bias especially regarding delisting risk (Chinese regulator last week gave a more positive initial view on the matter but SEC’s decision will be important as well on the condition if Alibaba is allowed to open its books by Chinese regulators which I believe it will https://wtvbam.com/2021/12/24/china-securities-regulator-says-vie-compliant-companies-can-list-overseas/), geopolitical discussions, the tension between US and China, better than expected earnings, etc. Assuming, negativity starts to be replaced by positivity, the initial stage of testing starts. Currently, I would say the trend is balanced and looking for further signals. From a fundamental point of view, many investors believe Alibaba is undervalued considering its growth and valuation compared to its domestic and international peers. This is also a positive prevailing bias, but it seems not enough to break the trend upwards. In the upcoming weeks and months, my hypothesis will be tested both by regulatory progress and quarterly earnings. If I am wrong, I will re-assess the situation, take it on the chin and move on.

I wanted to give the one aspect of my investment thought process, which becomes handy to see a bigger picture. Any slight advantage over other market participants can yield better returns, especially when it’s compounded. I believe a deeper understanding of the markets from this angle allows me to incorporate human behavior into investing. The theory of reflexivity is not useful by itself in most cases, but

Final thoughts

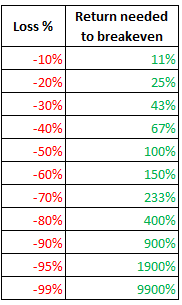

What the future will hold for the fund and overall stock market is impossible to say. For a century, many have come and gone to predict the market to no avail and that holds true today. You can estimate and get exact calculations where and when a satellite launched into space be in 5 years or anytime, but you can’t predict human behavior for the next day which is the main ingredient of the stock market. I believe over the next 10 years the market will return upwards of 20% in a given year and also there will be a time it will return -20% and the rest in between. My aim for the fund stands true today as it was when it started and it is simple: “Generate wealth for all partners. And in the meantime, try to realize it by achieving above-market returns. ” But rule #1 will always be as Warren Buffet says: “Dont lose money”. If you look at the table below, you will see how painful it is to return to break even. -50% loss will require to double your assets which might take years in certain circumstances.

From here onwards, I will publish quarterly commentary on the overall performance. If you have any questions, feel free to ask them by emailing me at [email protected].

Cordially,

Nizami Shirinov