To the Partners of AfterValue:

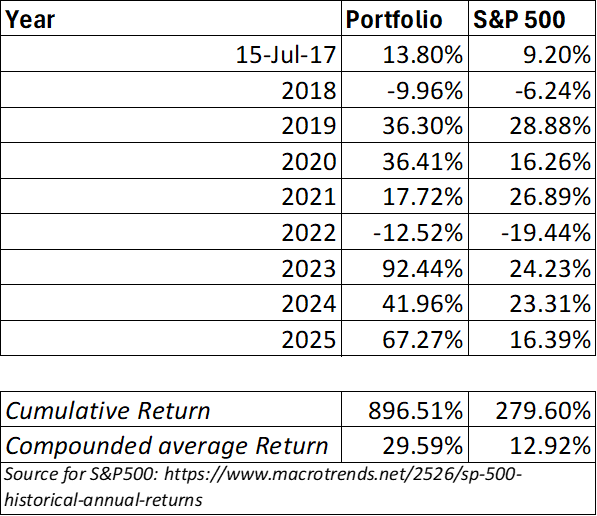

This past year has been a satisfactory one for our capital. Since we began this journey in mid-2017, our compounded annual gain has outpaced the broader market, thanks largely to a decision I made some time ago: to stop fretfully diversifying and instead put our eggs in a few baskets we really like—and then watch those baskets very closely. In 2025, AfterValue delivered a gain of 67.27%. While a “fat” year like this is always a pleasant surprise, one year’s weather doesn’t tell you much about the climate. The figure that truly matters is a long-term record. Since I began in mid-2017, the capital has grown at a compounded annual rate of 29.59%. In this business, a single year’s jump can often be attributed to the “tailwinds” of the market; however, compounding at nearly 30% over several years suggests that the philosophy of buying great businesses and holding them tight is serving well. If I have one regret regarding our performance over the last three or four years, it is that I didn’t spend more time doing absolutely nothing. Had I simply held onto our best ideas for longer periods, our returns, which are already quite good, would have been truly eye-popping.

In this business, your biggest enemy is often the person you see in the mirror every morning. It is tempting to “tinker” with a portfolio or to sell a great business just because the price has gone up. But the real wealth is made by letting the compound interest engine run without interruption. As long as I can keep my “itchy trigger finger” in check and strictly adhere to the discipline that got me here, I believe AfterValue’s future remains exceptionally bright.

The Cost of “Picking Up Pennies”

Most of our heavy lifting this year was done by Google. However, I must confess to a mistake in judgment regarding our strategy. I spent the year experimenting with “selling options”—essentially taking a small, guaranteed fee in exchange for capping our potential upside.

I quickly learned that when you own a wonderful business, trying to squeeze out a little extra income by selling away your gains is a fool’s errand. Because I sold “covered calls,” I was forced to sell our Google shares just as they were taking off. It was a classic case of reaching for a few loose coins and missing out on the whole pie. We won’t be repeating that experiment. In this game, the real money is made by sitting on your hands, not by trading away your best performers for a quick buck.

A New Home in Amazon

After exiting Google, I briefly parked cash in Berkshire Hathaway. I used a tool called “LEAPS,” which is simply a way to control more shares for less money upfront. It worked out well enough, but I soon realized that my fears of a market crash were keeping me from finding the next great long-term opportunity.

That search led me to Amazon. Today, I am 100% invested in this single business. Now, the academics who teach “Modern Portfolio Theory” would say I’m being reckless by not diversifying. But I look at it differently. If you found a business that was almost certain to be around and thriving 30 years from now, wouldn’t you want to own as much of it as possible as Warren Buffett would say? Amazon checks that mark. I have higher confidence that the company is likely to survive longer than many S&P500 companies out there including Google (search business specifically), Tesla, Walmart, Costco, Exxon. Despite its $2.5 trillion size, the company still possesses the soul and the hunger of a startup. They have anchored their success on two simple truths that will never go out of style: first-class customer service and unbeatable prices. As long as they deliver on those two fronts better than the next fellow, their “moat” will only continue to widen.

To me, Amazon is the modern-day Berkshire. It doesn’t pay a dividend; instead, it takes every dollar it earns and plows it back into the business to build a bigger future. While I won’t bore you with every detail of how I stumbled upon this opportunity, I will say this: the race for AI is no short-term fad, and Amazon is one of those better positioned businesses to cross the finish line. I’ll go out on a limb and predict that this $2.5 trillion business could easily become a $5 trillion one within the next five years. I don’t have a crystal ball, I record this today primarily as a way to keep myself honest/humble in 2030 in case I am wrong.

The American Tailwind and the Road Ahead

The American economy remains the most resilient engine in the world, firing on all cylinders. While the recent change in administration has caused some jitters and volatility, I believe the “Pro-Business” environment will push the market to new highs over the next few years.

However, even the best engines face friction. Looking out 10 or 20 years, I see two clouds on the horizon:

- The Talent Gap: America’s secret sauce has always been its ability to attract the smartest, hardest-working people from every corner of the globe. If America slows down immigration—especially for the high-tech researchers and the essential workers who build its homes and grow its food—US growth will inevitably slow down as its own population ages.

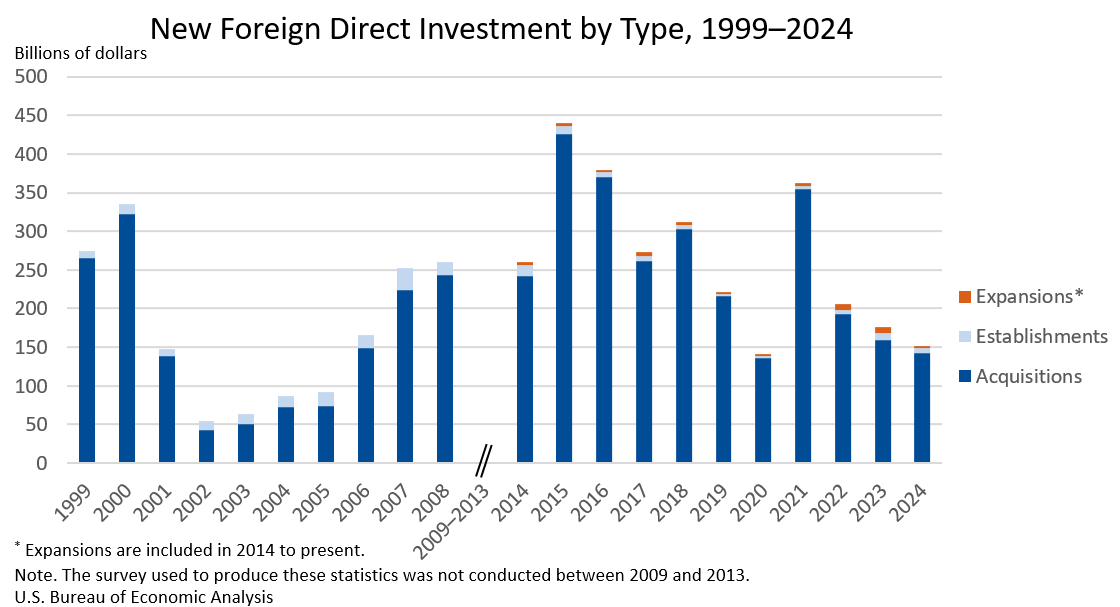

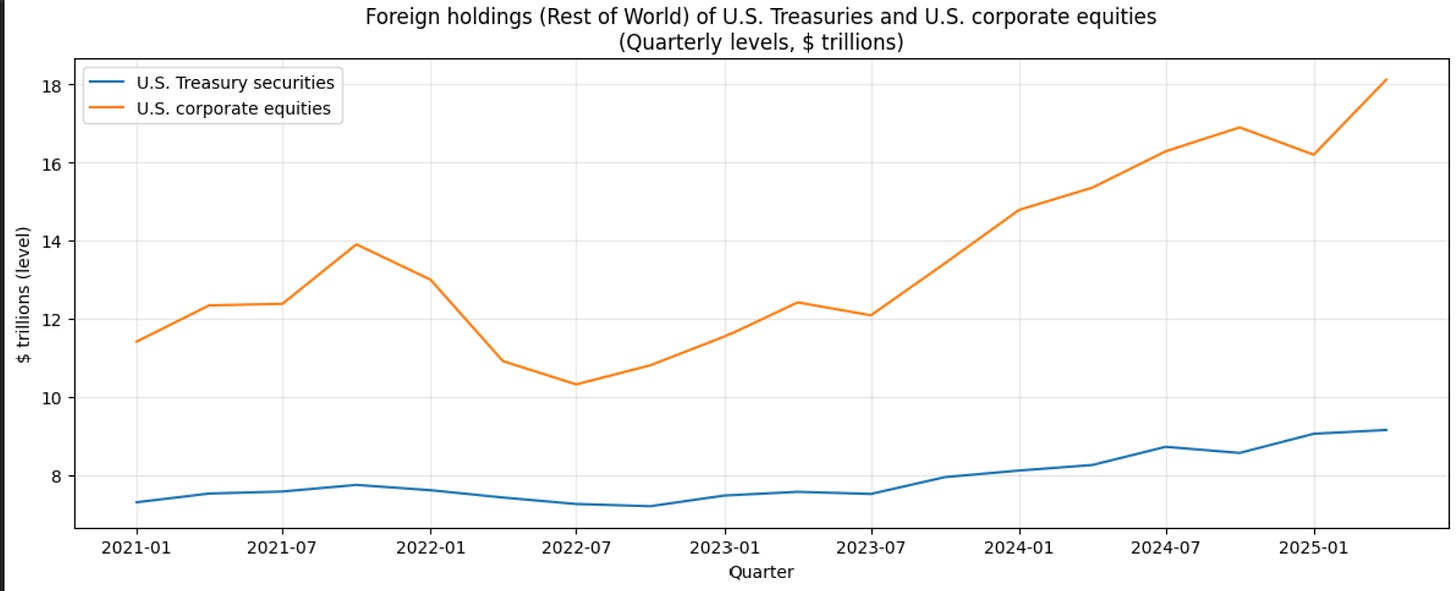

- Global Decoupling: We are seeing a shift where other countries are starting to look elsewhere to park their money. We track this through Foreign Direct Investment (FDI), which is a fancy way of saying “money people actually put into building businesses here” rather than just buying stocks.

The trend in FDI is a warning sign we shouldn’t ignore. If the world decides to build its factories and future elsewhere, the American “moat” starts to shrink.

If the USA continues down a path of “America First” policies, it may find that while it keep our neighbors out, it also keeps their capital out. A decline in Foreign Direct Investment (FDI) isn’t just a line on a graph; it’s a signal that the world is looking for alternative places to build the future. If that capital dries up, US markets will have to rely on “in-house” fuel— domestic savings and investment—to keep the engine running.

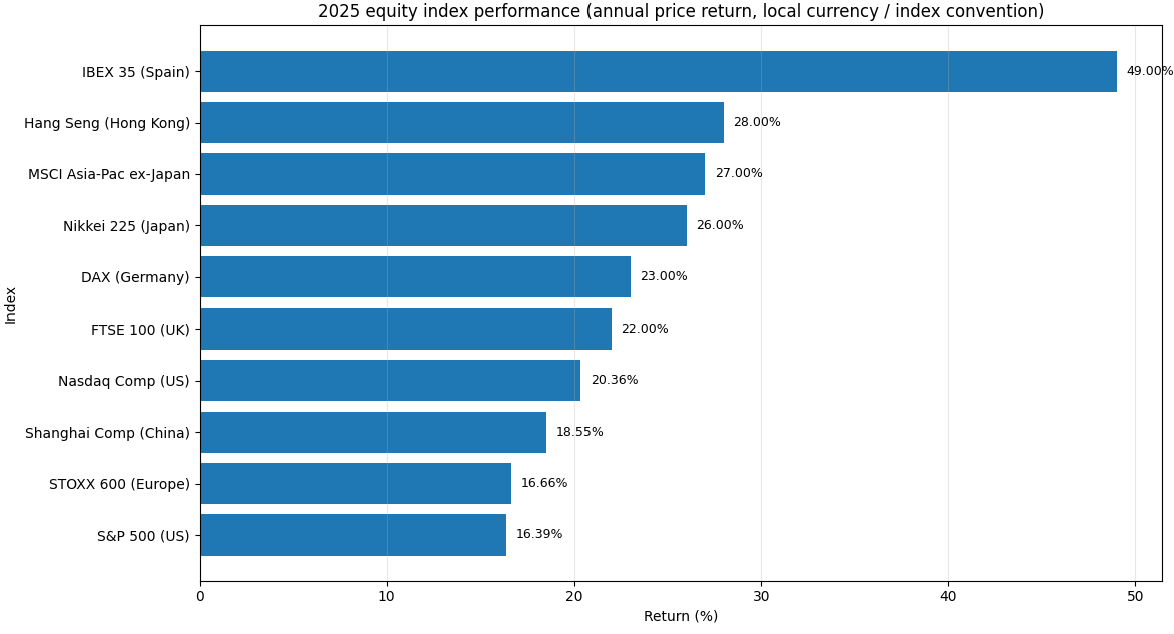

Overall, if you zoom out and look at the world, you will US market didn’t perform better than other markets.

You might ask why, given these risks, I don’t take my capital to foreign shores where prices might look “cheaper.” The answer is simple: I prefer to play on a field where I know the dimensions and the ground rules.

In the investment world, you should always put your money where your mouth is. When you invest abroad, you are exposed to political shifts, currency swings, and “information gaps” that can turn a “cheap” stock into a very expensive lesson. There is a reason the American market sells at a premium: it is the gold standard for transparency and shareholder rights.

Furthermore, I have never seen a collection of businesses more capable of global conquest than those born in America. American companies don’t just serve the 330 million people living here; they treat the entire world as their “Total Addressable Market.” They are the best in the business at exporting American innovation and capturing global growth.

So, while the clouds on the horizon are real, I’m not looking for a new home. I will continue to bet on the best businesses in the best neighborhood in the world, keeping my eyes wide open and my capital concentrated where it can do the most good.

If you simply have an idea you think is worth chewing over, I would be delighted to hear from you. You can reach me directly at [email protected]